Protecting Yourself from Identity Theft: A Comprehensive Guide to Cyber Awareness

In our increasingly digital world, identity theft has become a serious concern for many individualsThis blog aims to equip you with practical strategies and insights to protect yourself effectively from identity theft through careful cyber awareness.

What is Identity Theft?

Identity theft occurs when someone steals your personal information—such as your name, social security number, credit card details, or other financial data—to commit fraud. This can lead to unauthorized purchases, loans taken out in your name, and a tarnished credit score, among other repercussions.

Understanding the Risks

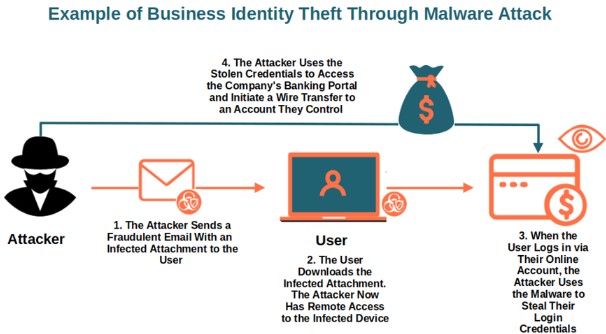

- Phishing Scams: Cybercriminals use deceptive emails or messages purporting to be from legitimate sources to trick you into revealing personal information.

- Data Breaches: Over the years, major companies and organizations have suffered from data breaches, exposing millions of users’ personal information for sale on the dark web.

- Public Wi-Fi: Unsecured public Wi-Fi networks can allow hackers to intercept your data when you access sensitive accounts.

- Social Media Oversharing: Oversharing personal information on social media platforms can provide fraudsters with the information they need to impersonate you.

Steps to Protect Yourself from Identity Theft

1. Strengthen Your Passwords

- Use Strong and Unique Passwords: Create complex passwords that include a mix of uppercase and lowercase letters, numbers, and special characters. Avoid using easily guessable information such as birthdays or common words.

- Use a Password Manager: A password manager can help you generate and store unique passwords for all your accounts, making it easier to maintain strong password practices.

2. Enable Two-Factor Authentication (2FA)

- Add an Extra Layer of Security: Wherever possible, enable two-factor authentication. This requires not only your password but also a second method, like a text message verification, to access your account.

3. Monitor Your Financial Statements

- Regularly Check Bank and Credit Card Statements: Look out for any unauthorized transactions or accounts you do not recognize. Report any suspicious activity to your bank immediately.

- Credit Report Monitoring: Obtain your credit report regularly (you’re entitled to one free report per year from each of the major credit bureaus) and check for any unfamiliar accounts or inquiries.

4. Stay Educated About Phishing Scams

- Recognize Red Flags: Be wary of unsolicited emails, messages, or phone calls requesting personal information. Legitimate organizations will never ask for sensitive information through these channels.

- Verify Requests: If you receive a suspicious message, contact the entity directly using official channels before providing any information.

5. Protect Your Devices

- Install Security Software: Use reputable antivirus and anti-malware software on all your devices to help protect against threats.

- Keep Software Updated: Regular updates ensure that your software has the latest security patches to protect against vulnerabilities.

6. Secure Your Wi-Fi Network

- Change Default Settings: Change the default username and password on your home router, and use a strong password to secure your Wi-Fi network.

- Enable Network Encryption: Use WPA3 (or at least WPA2) encryption to protect your network traffic from unauthorized access.

7. Limit Social Media Sharing

- Be Mindful of What You Post: Limit the amount of personal information you share publicly on social media. Review your privacy settings to restrict who can see your information.

- Friend Requests: Be cautious about accepting friend requests from people you do not know, as they may not have your best interests at heart.

8. Use Disposable Email Addresses

- Separate Your Email Accounts: Use disposable email addresses for online accounts, especially for services or websites you’re unsure about. This reduces the risk of your primary email being compromised.

9. Protect Your Personal Documents

- Shred Sensitive Papers: Shred bank statements, credit card offers, and other documents containing personal information before disposing of them.

- Secure Your Home: Keep sensitive documents, such as your social security card and financial statements, in a safe place.

What to Do If You Become a Victim of Identity Theft

If you discover that you are a victim of identity theft, act quickly:

- Report to Financial Institutions: Contact your bank and credit card issuers to report suspicious activity and freeze your accounts.

- File a Report with the FTC: Visit IdentityTheft.gov to report the identity theft and get a recovery plan based on your situation.

- Place a Fraud Alert: Contact one of the three major credit bureaus (Experian, Equifax, or TransUnion) to place a fraud alert on your credit report, making it harder for identity thieves to open accounts in your name.

- File a Police Report: Having a police report can help in disputing fraudulent charges.

Conclusion

Being aware of identity theft and taking proactive measures to protect yourself is essential in today’s digital age. By implementing the above strategies, you can significantly reduce your risk of falling victim to this prevalent crime. Remember, staying informed and vigilant is your best defense against identity theft. Always think before you click, share, or provide information online. Your safety and security depend on it!